|

|

|

UGF Lecture 6Management > Global Firm > Kojima > Case A

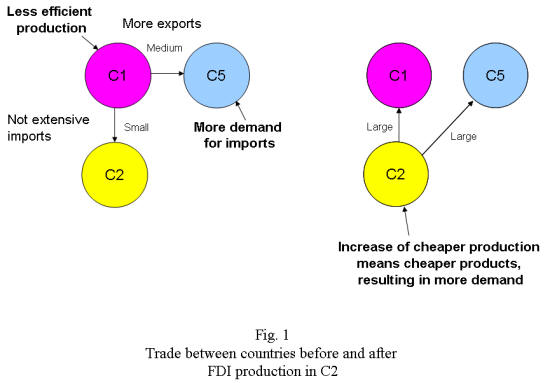

Case AIn this case Kojima argues that FDI flows from comparatively weak industries in Country 1 (C1) into Country 2 (C2) where the same industries are potentially comparatively advantaged (having numerous resources without the capability of exploiting them due to some developmental bottleneck, such as no local firms with the right technology or management). The FDI from C1 to C2 in these industries provides the missing factors required for C2. This enables development of the comparative advantage in C2 to competitive standards. The FDI has been carried out for the purpose of efficiency, to improve the competitiveness of investing firms. The FDI in C2 should end up supplying the customers in C1 at a lower production cost, thus enhancing welfare in C1 as new consumers can now afford it, which demonstrates that this type of investment is "Trade creating FDI". Industry profits will also increase. Fig.1 illustrates trade before and after FDI, where productivity is increased through establishing FDI production in C2.

As can be seen in the diagram, another country, C5 is another developed economy which is in demand of the product created in C1. Thus not only does the FDI in C2 benefit that country and C1, it also benefits other countries to which C1's good is sold, which in turn boosts the economies of C1 and C2. This type of FDI is also welfare-improving in C1, as although jobs may be lost in C1, if the industry can adjust internal operations, the least productive jobs can be moved and better jobs are created. Some employees can even be retrained to cope with competitive industries. Thus FDI relocates production in the industry in a way that makes many participants better off.

|

|