|

|

|

UGF Lecture 6Management > Global Firm > Kojima > Case A > Case B

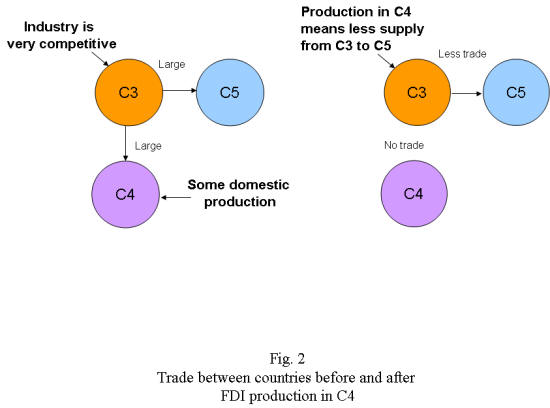

Case BIn this case Kojima discusses FDI from comparatively advantaged (most internationally competitive) industries in Country 3 (C3) into the same industries in Country 4 (C4), which already exist and may or may not be comparatively advantaged. In any case, they are more competitively disadvantaged than C3. The inward FDI will provide small benefit to the industry in C4, but it will still be less competitive than those in C3. This means that the markets supplied the production in C4 (and perhaps some third country markets) could have been more efficiently supplied by exports from C3 (Fig.2).

As can be seen, shifting production to C4 means that there are fewer resources in C3 to transfer to C5. An additional consequence to the investment is the rising of costs, which means that demand from C5 lessens, again resulting in less trade between C3 and C5. Thus FDI in C4 can be classified as "Trade destroying" and resulting in lower levels of welfare, particularly in C4, where the local customers have to buy products at a higher price.

|

|